Piotr Biernacki appointed as member of EFRAG SR TEG

Piotr Biernacki, ESG Reporting Partner at MATERIALITY, has been appointed as member of Sustainability Reporting Technical Expert Group (SR TEG).

Piotr Biernacki, ESG Reporting Partner at MATERIALITY, has been appointed as member of Sustainability Reporting Technical Expert Group (SR TEG).

Soon all large and some small and medium-sized enterprises will report sustainable development issues in accordance with the provisions of the CSRD directive.

On February 23, 2022, the European Commission announced a draft Directive on due diligence in the field of sustainable business development!

We are proud to announce that the commitment of our client – the CCC Group…

On January 20, 2022, draft basic standards for reporting on sustainable development issues were published.

On December 20, 2021, the European Commission published the first set of official responses to the Taxonomy questions.

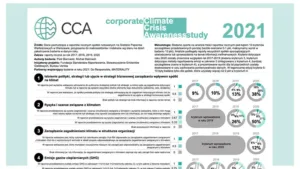

Are Polish companies climate-conscious? What are the priority management actions in the field of climate change?

Two delegated acts supplementing Regulation 2020/852 have been published in the Official Journal of the European Union.

The results of the first Climate Strategy Benchmark implemented by the UNEP / GRID-Warsaw Center…

We are very pleased with the success of the CCC Group for receiving the award for…

Congratulations to our client LUG S.A. on winning the main award in the category of companies listed on the NewConnect market

On September 15, 2021, the results of the CCA – Companies Climate Awareness Survey were announced.

We are proud to announce that Justyna Biernacka, Sustainability Managing Partner at MATERIALITY has been awarded…

On 21 April 2021, the European Commission adopted a package of measures related to implementing sustainable finance.

As part of the sustainable finance package approved on 21 April 2021, the European Commission announced a proposal of Corporate Sustainable Reporting Directive.

In the next two years, we will witness a fundamental change in corporate reporting. It will be implemented through a revision…

On February 20, 2020, the European Commission announced consultations on planned amendments…

A transcription of a discussion from the Polish Association of Listed Companies conference on ESG reporting and sustainable…

A week ago, I described best practice for climate reporting. Now it is worth to describe what changes …

If you are still wondering how to best report on issues related to climate or what you can learn from such reports, look no further.

A sustainable development strategy is a tool which complements a company’s business strategy with ESG …

ESRS is an abbreviation for the European Sustainability Reporting Standards. CSRD introduces ESRS to non-financial reporting, which means that companies will no longer be able to choose reporting standards at their own discretion, which has taken place so far. Most of companies have applied the GRI Standards, SIN (Standardy Informacji Niefinansowej, Non-financial Information Standards) or has reported in line with the provisions of the Polish Accounting Act Art. 49b. We know already today that reports covering 2024 will have to be published using ESRS. ESRS have not came from nowhere – they are similar to the GRI Standards from October 2021, they meet the TCFD guidelines, they also include parts of the American SASB standards, but, in our opinion, they are very stringent and force companies to diligently and reliably collect and process non-financial data. At MATERIALITY, we provide our clients with tools to collect quantitative data already in accordance with the 2021 GRI Standards and ESRS, which guarantees a good preparation for the upcoming obligations. You can find more practical tips on ESRS in our article HERE.

TCFD is an abbreviation for the Task Force on Climate-related Financial Disclosures, guidelines for companies, which were first published in 2017, that should be used for reporting climate change-related issues. This is a set of guidelines prepared by the Financial Stability Board, an international organization, which have quickly gained approval from financial institutions, investors and other stakeholders. Reporting climate-related issues in accordance with the TCFD guidelines is not only good practice but also proves that the company manages its climate impacts. The TCFD Guidelines include 11 specific recommendations (e.g. a description of the way how the management board and the supervisory board oversee risks and opportunities related to climate or disclosure of greenhouse gases emissions in scopes 1, 2 and 3) divided into four thematic blocs: corporate governance and management system, strategy, risk management as well as metrics and targets.

The EU Taxonomy is a kind of taxonomy defining what part of a company’s activity is environmentally sustainable. The taxonomy is, de facto, an “analytical layer” to financial reports thanks to which in reports covering 2021 companies showed what share of revenues, CapEx and OpEx were Taxonomy eligible. In reports covering 2022, companies will not only have to qualify their revenues, CapEx and Opex but also check whether their activity meets the Technical Screening Criteria of the Taxonomy. There are plans to introduce a social Taxonomy that would cover human rights issues in a similar way.

Currently, the most popular international sustainability reporting standards are the GRI Standards. The SASB standards, that just like the GRI Standards are now being updated, are equally popular in the English-speaking countries. In Poland, the absolute minimum reporting on non-financial data is in accordance with the requirements of the Accounting Act Art. 49b, which implements the NFRD. Many companies prepare their first non-financial reports basing on the Polish Non-financial Information Standards (SINs, Standardy Informacji Niefinansowych). The most important standards are currently ESRS that will have to be used for preparing reports covering 2024 by companies already subject to NFRD. At MATERIALITY, we work with clients using GRI Standards and in alignment with ESRS. |

The term „CO2 emissions” covers in fact emissions of a few greenhouse gases. At MATERIALITY, during our cooperation with clients, we educate about factors that increase or reduce CO2 emissions in scopes 1, 2 and 3 in line with a proven and internationally recognized GHG Protocol methodology and we create de-carbonization plans.

Well-identified and described climate risks do not only meet the TCFD guidelines, something that is necessary to be included in reports written in accordance with the future ESRS, but they are also a valuable insight for the company which will then add such risks to its management system in order to be more resilient to what awaits us in the future. We conduct climate risks assessments using our own proven methodology and the client receives a full report with categorization of the identified risks, threats and opportunities related to climate change.

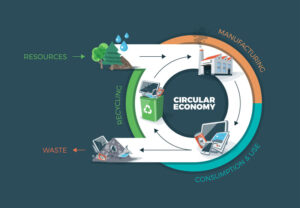

Circular economy (CE) or closed-loop economy – these terms are used interchangeably. CE refers to issues such as raw materials and materials, wastes, quality of products and services or business models that promote the switch from linear systems. Qualitative and quantitative indicators related to circular economy are present in the GRI Standards, ESRS and in the Taxonomy and gain importance in the transition to environmentally sustainable activity. CE is an important ESG area in the European Green Deal.

ESG materiality assessment, similarly to accounting, defines what the company should report on. Such assessment should be conducted by each and every larger organization and the results of the assessment will be used while working on an ESG report or strategy. Important: so far, in line with the GRI standards, companies showed a materiality matrix which depicted materiality of a given ESG topic from the perspective of external stakeholders as well as of the organization itself, but now the updated GRI Standards and the future ESRS introduce the so-called double materiality principle. The principle introduces a new definition and new parameters of ESG matters’ materiality for the company – we assess what is the negative impact of the company on the environment and on people and how ESG matters impact the company. Conducting materiality assessments is a requirement described in the 2021 GRI Standards and ESRS. At MATERIALITY we already carry out materiality assessments for clients in accordance with the 2021 GRI Standards and ESRS.

It is an abbreviation for the Corporate Sustainability Due Diligence Directive which is currently being processed. The document will impose a requirement on companies to manage environmental and social risks both in their supply chain and their whole value chain. This means that companies will be responsible for what happens at their suppliers and subcontractors. More information on what companies and from when will be covered by these regulations can be found HERE. |

OUR ADDRESSES:

Registered address

5A Grzybowska St,

Warsaw, 00-132, Poland

Office address:

101 Jerozolimskie Avenue Apt 7,

Warsaw 02-011, Poland

Privacy Policy of MATERIALITY.PL

Read our policy „Privacy Policy”

MATERIALITY Sp. z o.o.,

5A Grzybowska St, Warsaw, 00-132, Poland

All information provided on the website is indicative and does not constitute legal nor any other form of advice. MATERIALITY is not responsible for the use of the information provided on the website without prior seeking professional advice from MATERIALITY experts.